In a choppy market, even the smartest lawyers make mistakes. When the market drops like a stone, those mistakes are much costlier. David Hunter points out the pitfalls to avoid so you can protect your investments and watch your money grow — no matter what the market does.

Table of contents

Mistake No. 1: Making Choices Based on News Headlines

When markets fall, the news gets scary. Many attorneys forget their training and make quick decisions based on alarming headlines.

The Cost: Studies show that reacting to news can lower your returns by up to 2% in performance each year. For an attorney with $500,000 invested, that could mean losing $10,000 every year. Over time, that adds up to a lot of money!

The Fix: Write down your investment plan before the market gets rocky. Then, review it when you feel worried about market news. This is like telling clients to follow written agreements instead of making quick decisions.

Mistake No. 2: Trying to Time the Market

Many attorneys think they’re smart enough to know when to buy and sell stocks at the perfect time. Usually, they’re wrong.

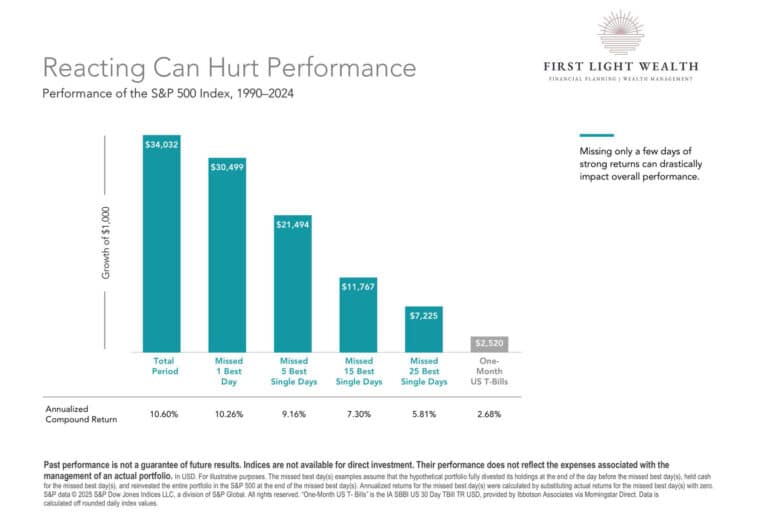

The Facts: Supporting research from Dimensional Fund Advisors shows that if you had put $1,000 in the stock market but missed just the five best days between 1990-2023, your yearly return would drop from 10.21% to 8.73%. Miss the top 15 days, and your return falls to 6.82%, cutting your final amount by nearly 65%.

Reality Check: The market’s best days often happen right after the worst days. Even the smartest attorneys can’t predict these important moments.

Mistake No. 3: Using the Same Plan for All Your Money

Attorneys often use one approach for all investments, no matter when they’ll need the money.

The Problem: This leads to either being too careful (missing growth) or not careful enough (having to sell investments at the worst time).

Smart Strategy: Split your money into three groups.

- Money you need soon (1-2 years): Keep in safe places like savings accounts.

- Money you’ll need in a few years (3-5 years): Use safe bonds.

- Money for the future (5+ years): Invest in diverse stocks.

This plan helps you feel safe during market drops while still growing your money for the future. Retirees can apply the same principle. Keeping one to two years of income withdrawals in cash can help insulate these expenditures from short-term market fluctuations.

Mistake No. 4: Forgetting How Markets Recover

When markets fall, many attorneys focus on how bad things are now instead of remembering how markets bounce back.

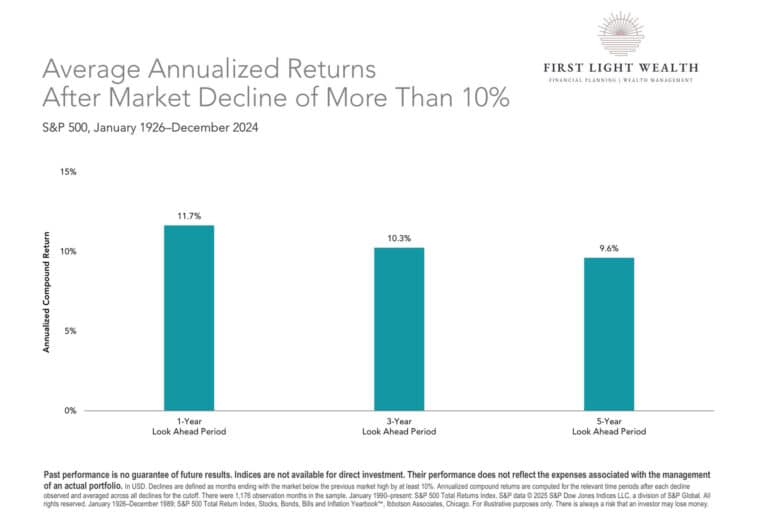

History Lesson: Since 1926, after big market drops (more than 10%), stocks have gained an average of 11.7% in the first year afterward. Over three and five years, returns averaged 10.3% and 9.6%.

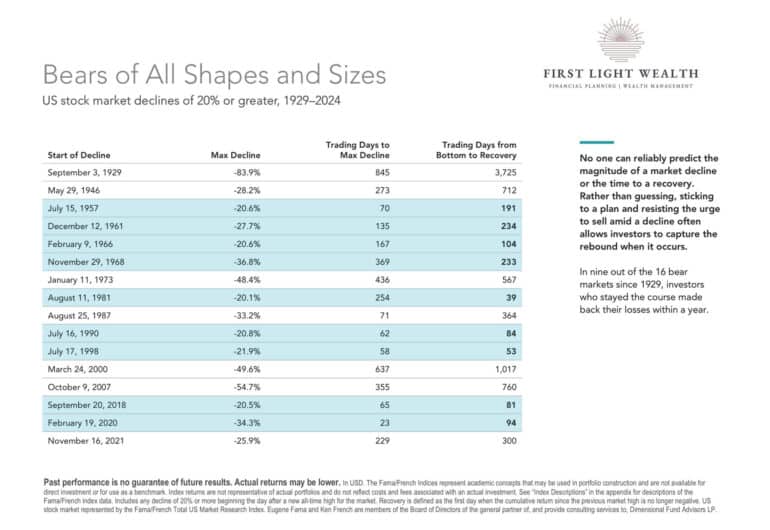

Even more important: Since 1929, we’ve had 16 major market drops (20% or more). In nine of these 16 cases, investors got their money back within just one year.

New Thinking: See market drops as temporary problems, not permanent losses. This is like telling clients to view legal challenges as hurdles to get over, not walls that stop them.

Mistake No. 5: Not Connecting Your Work and Investments

Many attorneys don’t think about how their law practice and investments affect each other.

The Problem: Law firm income often goes down during bad economic times. If the market also drops at the same time, attorneys might face money troubles from both sides if they need to sell investments when prices are low.

Smart Strategy:

- Keep more cash on hand (12-18 months of expenses).

- Think about how your law practice performs during good and bad economic times.

- Make sure your investments don’t have the same ups and downs as your practice.

- Set up credit lines during good times so you don’t have to sell off investments during bad times.

Turn Market Drops Into Opportunities

By avoiding these five big mistakes, attorneys can turn market drops from scary problems into chances to get ahead. The careful thinking that makes you a good lawyer can also make you a good investor.

Remember that market drops, like tough cases, need patience and sticking to proven methods instead of quick reactions. By following these tips, you can protect and grow your money no matter what the market does, letting you focus on your law practice with confidence about your financial future.

Sources

- Dimensional Fund Advisors LP, Investment Principles for Navigating Market Volatility, Reacting Can Hurt Performance, Accessed April 2025.

- Dimensional Fund Advisors LP, Investment Principles for Navigating Market Volatility, Average Annualized Returns After Market Decline of More Than 10%, Accessed April 2025.

- Dimensional Fund Advisors LP, Investment Principles for Navigating Market Volatility, Bears of All Shapes & Sizes, Accessed April 2025.

Read David Hunter’s article “Attorney Financial Planning Made Simple: 4 Vital Signs.”

Image © iStockPhoto.com.

Don’t miss out on our daily practice management tips. Subscribe to Attorney at Work’s free newsletter here >